Economic Environment

There is a lot of uncertainty in the global economy today, affecting not only individual countries but also entire regions. Inflation remains a major concern, staying well above pre-COVID levels. At the same time, many people are hopeful about the new opportunities that AI-driven industries could bring.

In the United States, a change in administration has led to shifts in economic priorities. These changes are influencing how the world’s largest economy plans to support future growth, including a move away from some renewable energy policies.

As AI continues to grow, many new data centres are being built to meet rising demand. However, it is still unclear how these facilities will be powered in the long run. For now, many rely on gas-powered turbines, with the intention of switching to cleaner energy sources over time.

There has also been progress in nuclear energy, particularly in small and advanced modular reactors. Major technology companies are supporting these efforts as they search for affordable, clean, and reliable power. Similar developments are taking place in fusion energy. While progress is being made, fusion technology is still some years away from being widely used.

Hydrogen & Derivatives

It has not been a strong year for hydrogen, especially when compared with the highly optimistic period between 2020 and 2024. Many projects have been paused or cancelled, leading some to claim that hydrogen is a dead end for energy development and that it is time to move on. We do not share this view.

While several companies, including major oil and gas players, have scaled back or abandoned certain projects ([1] FT (01 Dec 2025)), research into how hydrogen’s chemical energy can be used effectively is continuing. Many smaller projects are still moving forward, often funded privately and therefore receiving less public attention. According to a study commissioned by the Energy Council, around $35 billion worth of new hydrogen projects reached final investment decision, representing an increase of more than 50% compared with 2020 ([2] FT (09 Sep 2025)).

New technologies are also being tested, such as methane pyrolysis, which can produce hydrogen without emitting CO₂ ([3] FT (20 Nov 2025)). In addition, several green ammonia projects are under development, helping to address the challenges of transporting pure hydrogen over long distances.

From a regional perspective, Asian countries—particularly China and Japan—are leading the way in developing hydrogen projects. The United States continues to offer some support for hydrogen, while the European Union remains committed to building a hydrogen-based industry. In the UK, the government announced in April 2025 a shortlist of 27 projects that will receive support through the HAR2 scheme ([4] DESNZ (Apr, 07 2025)).

SMR & AMR

2025 has been a relatively strong year for small modular reactors (SMRs) and advanced modular reactors (AMRs). In the UK, the government’s SMR competition concluded with Rolls-Royce receiving official backing to build the country’s first modular reactor. In addition, Great British Energy committed £2.5 billion to support the development of the sector. Centrica also partnered with X-Energy, pledging £10 billion to develop and build 12 advanced modular reactors, each with a capacity of 80 MW, in North East England.

Similar developments are taking place in the United States, where AI-driven companies are looking for stable and reliable sources of power. In August 2025, SMR developer Kairos signed an agreement with the Tennessee Valley Authority (TVA) and Google to supply electricity to Google’s data centres. Equinix, a major data centre operator, also signed a 500 MW agreement with Oklo and pre-ordered 20 reactors from Radiant Nuclear ([5] FT(18 Aug 2025)).

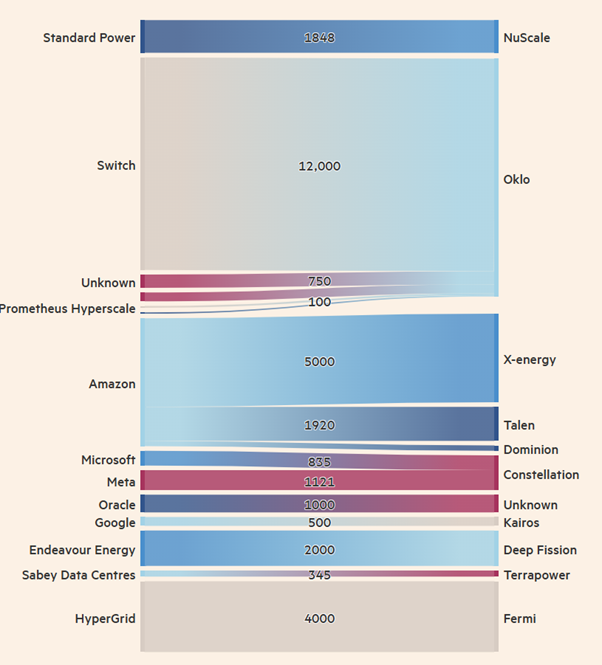

Overall, by October 2025, technology companies had signed agreements for a total of 32 GW of electricity capacity to be generated by SMR and AMR technologies.

Power deals between tech and nuclear developers (Source: [6] FT (5 Oct 2025))

Fusion

According to the Fusion Industry Association, there are currently 53 fusion energy companies, with more than half based in the United States. These companies have raised around $9 billion in private investment, along with roughly $800 million in public funding ([7] FT (2025, 6 Oct)).

High-profile investors, including Bill Gates, Sam Altman, and Jeff Bezos, are backing fusion technology. The U.S. president has also shown interest, highlighted by the December 2025 merger of Trump Media Group with Google-backed TAE Technologies ([8] FT (2025, 18 Dec)). At the same time, Google signed an agreement to purchase power from a demonstration plant being built by Commonwealth Fusion Systems in Massachusetts ([9] FT (2025, 30 Jun)), and Microsoft signed a similar power purchase agreement with Helion, a fusion company backed by Sam Altman.

In Europe, investment is smaller but growing. EQT and Siemens Energy jointly backed Marvel Fusion ([10] FT (2025, 25 Mar)), a German startup focused on inertial confinement technology. Later in the year, Cherry Ventures and Balderton Capital invested in Proxima Fusion, another German company developing proprietary stellarator technology. Funding in Europe remains several times smaller than in the United States.

Impact of AI Development on Energy Sector

Artificial intelligence (AI) is affecting the energy sector in many ways. One key benefit is its potential to help discover and use more sustainable energy sources and optimize energy consumption.

However, for now, the biggest impact of AI on the energy industry is simply increased demand for power. This surge in energy needs has even led to aviation turbines being repurposed as electricity generators. Another effect of this rising demand for cleaner, more sustainable energy is the growing interest in emerging technologies such as small modular reactors, fusion, and hydrogen.

Sources:

[1] FT (01 Dec 2025) https://www.ft.com/content/6d3bc630-bb0b-4222-b302-634e18c8fd32

[2] FT (09 Sep 2025) “Clean hydrogen investment tops $110bn to defy industry pessimism” https://www.ft.com/content/48a65f04-46d7-47dc-aaaa-f54122021de4

[3] FT (20 Nov 2025), “ Could an emerging technology unlock clean hydrogen’s potential?”, https://www.ft.com/content/802f5cea-f49b-4702-8bbf-551618311048

[4] DESNZ (Apr, 07 2025) Notice “Hydrogen Allocation Round 2 (HAR2): projects”,https://www.gov.uk/government/publications/hydrogen-allocation-round-2-har2-projects

[5] FT(18 Aug 2025) “ Google, Kairos and Tennessee Valley Authority ink landmark nuclear power deal ”, https://www.ft.com/content/96f22d75-78d2-4038-9ee5-54bebdcfb1ff

[6] FT (5 Oct 2025) “US and investors gambling on unproven nuclear technology, warn experts”, https://www.ft.com/content/8a18e722-3efa-404e-9f2a-709eed877f18

[7] FT (2025, 6 Oct), “Can nuclear fusion save the planet”, https://www.ft.com/content/eac809b2-bb90-42a1-a465-73655aafba43

[8] FT (2025, 18 Dec) “Trump media group agrees $6bn merger with Google-backed fusion energy company”, https://www.ft.com/content/1e1978d5-535b-4241-872f-38db778df694

[9] FT (2025, 30 Jun) “Google agrees deal to buy power from planned nuclear fusion plant”, https://www.ft.com/content/63c3d7b6-2eac-4c63-a650-8a140b64738c

[10] FT (2025, 25 Mar) “Germany’s Marvel Fusion raises €113mn as nuclear fusion race heats up”, https://www.ft.com/content/c9112c79-51aa-4e66-bd23-77cbfad9b321 [1] FT (2025, 27 Dec), «Data centres turn to aircraft engines to avoid grid connection delays», https://www.ft.com/content/8deb1518-b650-4a21-b7d1-3e6180560056

Leave a Reply